The recent liquidation of Bitcoin by German authorities has raised eyebrows in the cryptocurrency community. Valued at approximately $3 billion, the German government sold 49,858 BTC tokens from June 19 to July 12 for €2.6 billion or $2.9 billion. This move was deemed an “emergency” measure linked to an ongoing criminal investigation, but it has faced criticism from politicians and business leaders.

Despite assurances that the sales were conducted in a manner that supported the market, the value of Bitcoin plummeted by more than 22% during the sale period, dropping from $65,695 to $53,717. This significant decline has led many to question the actual impact of such a large sell-off on the market.

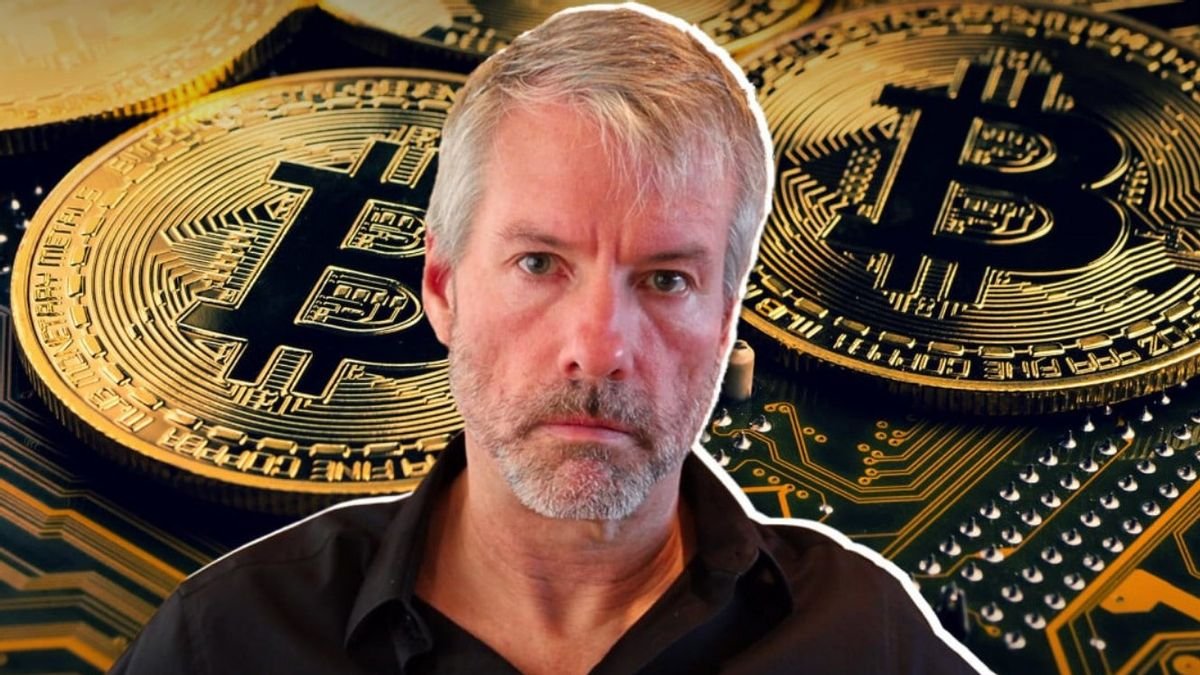

Michael Saylor, the chairman of MicroStrategy and a prominent Bitcoin advocate, has been vocal in his opposition to the German government’s decision. Saylor, known for his unwavering support of Bitcoin, criticized the sell-off by stating in German, “It’s not an emergency until you run out of Bitcoin.” His statement underscored his strong belief in the potential of Bitcoin and the importance of holding onto the cryptocurrency.

Saylor’s company, MicroStrategy, made headlines in 2020 for consistently investing in Bitcoin, with a substantial unrealized profit of $6.2 billion. Saylor’s advocacy for Bitcoin as a key component of modern financial strategies highlights his conviction in the digital asset’s long-term value.

German lawmaker Joana Cotar echoed Saylor’s sentiments, stating that Bitcoin should be held as a reserve asset and expressing regret over the government’s decision to sell off its holdings. Cotar emphasized the growing recognition of Bitcoin by major financial institutions and criticized the sell-off as unnecessary.

The backlash against Germany’s crypto liquidation has been more pronounced compared to other countries, such as El Salvador. In 2021, El Salvador adopted Bitcoin as legal tender and currently holds 5,508 BTC worth around $300 million. The Central American nation has embraced Bitcoin as a regular form of currency and implemented regulations to facilitate private investment in digital assets.

El Salvador’s proactive approach to Bitcoin contrasts with Germany’s decision to liquidate its reserves, sparking discussions about the role of virtual currencies in national economies. As more countries explore the potential benefits of integrating Bitcoin into their financial systems, the debate over the impact of cryptocurrency on traditional economies continues to evolve.

The concerns raised by Michael Saylor and others regarding Germany’s large-scale crypto liquidations will be closely monitored by Bitcoin enthusiasts in the coming days and weeks. The contrasting approaches of different nations towards Bitcoin highlight the growing significance of cryptocurrency in the global financial landscape.